Some Known Questions About Hard Money Georgia.

Wiki Article

The Buzz on Hard Money Georgia

Table of ContentsLittle Known Facts About Hard Money Georgia.The Of Hard Money GeorgiaSome Known Details About Hard Money Georgia Hard Money Georgia Things To Know Before You Buy

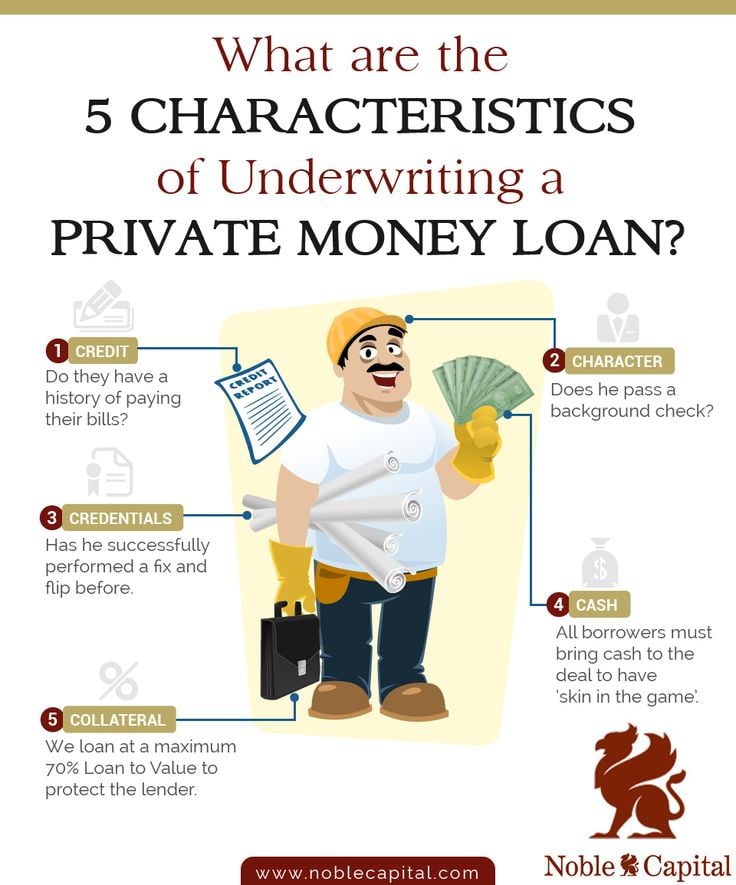

The optimum appropriate LTV for a difficult cash financing is generally 65% to 75%. That's just how much of the building's cost the lender will certainly agree to cover. For instance, on a $200,000 house, the optimum a tough cash loan provider would be prepared to lend you is $150,000. To acquire the property, you'll have to come up with a down settlement huge enough to cover the remainder of the acquisition price.

By contrast, rate of interest prices on hard money loans start at 6. 25% however can go much greater based upon your location as well as the residence's LTV. There are various other costs to remember, as well. Hard money loan providers usually charge points on your lending, occasionally referred to as origination charges. The factors cover the management prices of the lending.

Points are typically 2% to 3% of the lending amount. 3 points on a $200,000 car loan would be 3%, or $6,000.

Hard Money Georgia for Beginners

You can anticipate to pay anywhere from $500 to $2,500 in underwriting charges. Some hard cash lenders likewise charge early repayment penalties, as they make their money off the passion charges you pay them. That indicates if you repay the financing early, you may have to pay an added fee, including in the finance's cost.This indicates you're most likely to be supplied funding than if you requested a traditional home loan with a suspicious or thin credit report. If you require cash rapidly for improvements to flip a home commercial, a hard cash car loan can offer you the money you need without the headache and also paperwork of a standard home loan.

It's a strategy financiers make use of to buy investments such as rental buildings without using a lot of their own assets, as well as difficult money can be helpful in these scenarios. Difficult cash car loans can be beneficial for genuine estate capitalists, they must be made use of with care specifically if you're a beginner to genuine estate investing.

If you default on your financing repayments with a hard money lending institution, the repercussions can be severe. Some loans are directly guaranteed so it can harm your credit history.

The Main Principles Of Hard Money Georgia

To discover a reputable loan provider, talk with relied on real estate agents or home loan brokers. They might be able to refer you to loan providers they have actually dealt with in the past. Hard money view it now loan providers likewise usually attend genuine estate financier conferences to make sure that can be a good place to get in touch with loan providers near you.Equity is the worth of the building minus what you still owe on the mortgage. Like hard money car loans, house equity finances are safeguarded financial debt, which means your home acts as collateral. The underwriting for house equity fundings likewise takes your credit report history and revenue right into account so they tend to have lower passion rates as well as longer payment periods.

When it involves moneying their next bargain, investor and business owners are privy to a number of offering choices basically made for property. Each includes specific needs to accessibility, as well as if used appropriately, can be of substantial advantage to financiers. Among these financing kinds is hard cash lending.

It can also be called an asset-based finance or a STABBL financing (short-term asset-backed bridge lending) or a bridge car loan. These are obtained from its characteristic short-term nature as well as the requirement for concrete, physical collateral, typically in the type of genuine estate home.

Hard Money Georgia Can Be Fun For Everyone

As a result, needs might vary considerably from loan provider to lending institution. If you are seeking a car loan for the initial time, the approval process could be fairly rigid as well as you might be called for to give additional details.

This is This Site why they are primarily accessed by actual estate entrepreneurs who would normally call for quick funding in order to not lose out on warm opportunities. Additionally, the lender primarily thinks about the worth of the possession or building to be acquired instead than the borrower's personal finance background such as credit rating or income.

A conventional or small business loan might occupy to 45 page days to shut while a tough cash funding can be enclosed 7 to 10 days, in some cases quicker. The convenience and rate that difficult money fundings provide remain a significant driving pressure for why genuine estate investors pick to utilize them.

Report this wiki page